Transferring Receivables to Secondary Insurance Carriers

When processing payments in AcuityLogic Billing, you can transfer outstanding receivables for a claim to a secondary insurance carrier. You can do this for individual line items or for all line items in a claim.

When you transfer receivables to a secondary insurance carrier, AcuityLogic creates a secondary claim for that carrier. You can set the status of the line items you transfer to one of the following:

- On Hold

- Ready to Bill

- Billed

AcuityLogic determines the status of the line items in the original claim based on the remaining receivable amounts after the transfer.

To transfer receivables to secondary insurance carriers

- Click Process Payment, and select Carrier Payment or Patient Payment.

The Carrier Checks or Patient Checks window opens.

- Perform one of the following actions:

- Click +New Payment, and record information for the new payment.

- Search for an existing payment. See Searching for Payments.

- In the payment details window, find claims related to the payment by entering claim information in the Related Claims panel and then clicking Search.

The claims that meet your search criteria are displayed.

- Click the +/- icon in the row for a claim to indicate the payment either overpays or underpays the claim.

The Claim Adjustments window opens.

- In the Payment Amount field, enter the total amount to pay towards the claim from the payment.

- Make adjustments to the claim as necessary.

- Perform one of the following actions to transfer receivables:

- To transfer receivables for a line item, enter the amount to pay towards a line item in the Payment Amount column, and select Bill To Insurance --> Transfer Balance to Another Insurance from the Adjustment Type drop-down list.

- To transfer receivables for the entire claim, enter the amount to pay towards each line item in the Payment Amount column, and click the Transfer Balance icon (

) . The Bill To Insurance --> Transfer Balance to Another Insurance adjustment is automatically selected for each line item with an outstanding receivable amount.

) . The Bill To Insurance --> Transfer Balance to Another Insurance adjustment is automatically selected for each line item with an outstanding receivable amount.

The Transfer Balance to Secondary Insurance section appears.

- In the Comment fields, enter comments for each line item as necessary.

- Select the insurance carrier you want to transfer receivables to in the Carrier drop-down list.

The Patient Insurances section displays all the active insurance carrier/plan combinations from the patient’s profile in AcuityLogic POS. To see other active and inactive carrier/plan combinations accepted by your office, enter the appropriate criteria in the search field. Any carriers returned by the search that are not in the patient’s profile are listed in Active and Inactive sections of the drop-down list.

- From the Plan drop-down list, select the insurance plan you want to transfer receivables to.

- Click Save.

The Transfer Unpaid Balance to Secondary Carrier window appears.

- Select one of the following statuses for the line items you are transferring to the secondary carrier:

- On Hold (default)

- Ready to Bill

- Billed

- If the billing mode of the secondary claim is EDI, select the way to generate the secondary claim from the transmission drop-down list.

The transmission type you select is automatically populated in the Claim Supplemental Information section of the Edit Claim window.

- Click Transfer Balance.

AcuityLogic transfers the receivables and creates the secondary claim.

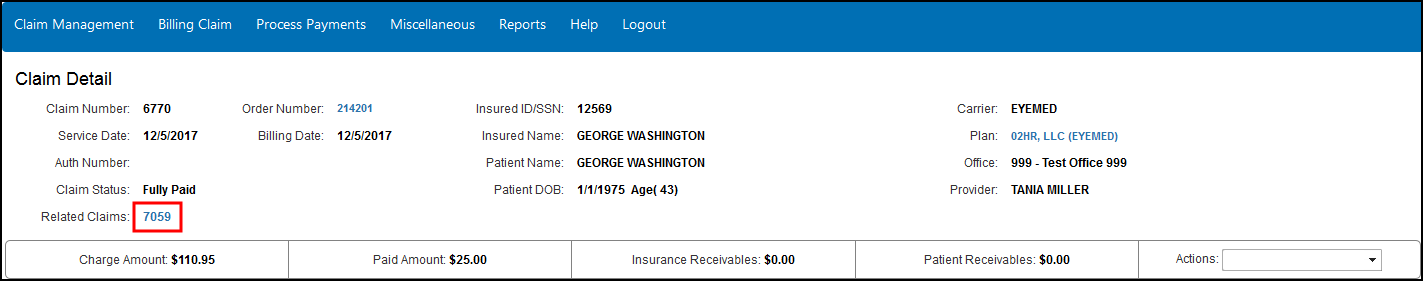

- Open the Claim Detail window for the original claim, and click the link next to Related Claims to review the secondary claim.