Comparing Average Cost Valuation Methods

The two average cost valuation methods differ in the average cost used for calculations.

Average Cost by Company

Using Average Cost by Company, all locations are combined for calculations and all locations use the same average cost.

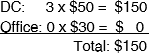

Based on the example in Understanding Inventory Valuation and Item Cost, if the first three frames were received at the distribution center (DC) at $50 and the fourth frame was received at an office at $30:

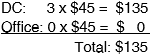

- Transaction Summary:

- Resulting Inventory Value:

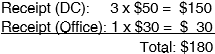

If a frame is sold at $200, the company average cost is used for COGS:

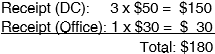

- Transaction Summary:

- Resulting Inventory Value:

Average Cost by Office

Using Average Cost by Office, each location calculates average cost independently.

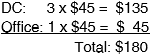

Based on the example in Understanding Inventory Valuation and Item Cost, if the first three frames were received at the distribution center (DC) at $50 and the fourth frame was received at an office at $30:

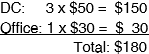

- Transaction Summary:

- Resulting Inventory Value:

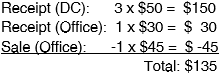

If a frame is sold at $200, the office average cost is used for COGS:

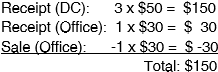

- Transaction Summary:

- Resulting Inventory Value: