Calculating Sales Tax for Transactions Manually

You may be required to calculate the total sales tax for transactions manually if the Tax Calculator is unavailable.

- In AcuityLogic POS, open a patient profile and click the Orders tab.

- Open the Pricing window using one of the following methods:

- Create an order and click Complete Order to Pricing.

- Select Price from the Actions drop-down list next to an order.If the Tax Calculator is unavailable, AcuityLogic displays a message when you open the Pricing window. Review the message and click OK to enter tax rates manually.

- Click the tax amount link in the Tax column for an item in the order.

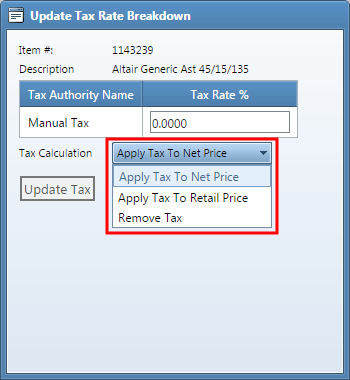

The Update Tax Rate Breakdown window opens.

- Type the total tax rate in the Tax Rate % field for the item.The total tax rate is the sum of the tax rates for all tax authorities. For example, enter a total tax rate of 8% if the tax rates for the tax authorities are 6.5% and 1.5%.

- Select one of the following options in the Tax Calculation drop-down list, if needed:

- Apply Tax To Net Price: Calculates tax for the item based on the net price after discounts. This is the default option selected.

- Apply Tax To Retail Price: Calculates tax for the item based on the retail price.

- Remove Tax: Does not charge tax for the item.

- Click Update Tax.

- Repeat steps 3–6 for each item in the order.