Setting Up Company Tax Rates

After you set up tax authorities for your company, you can set up tax rates for each item type for each tax authority.

- From the Admin home screen, click Company Information.

The Company Information screen opens.

- Under Tax Information, click the Review hyperlink.

The Company Tax Setup window opens.

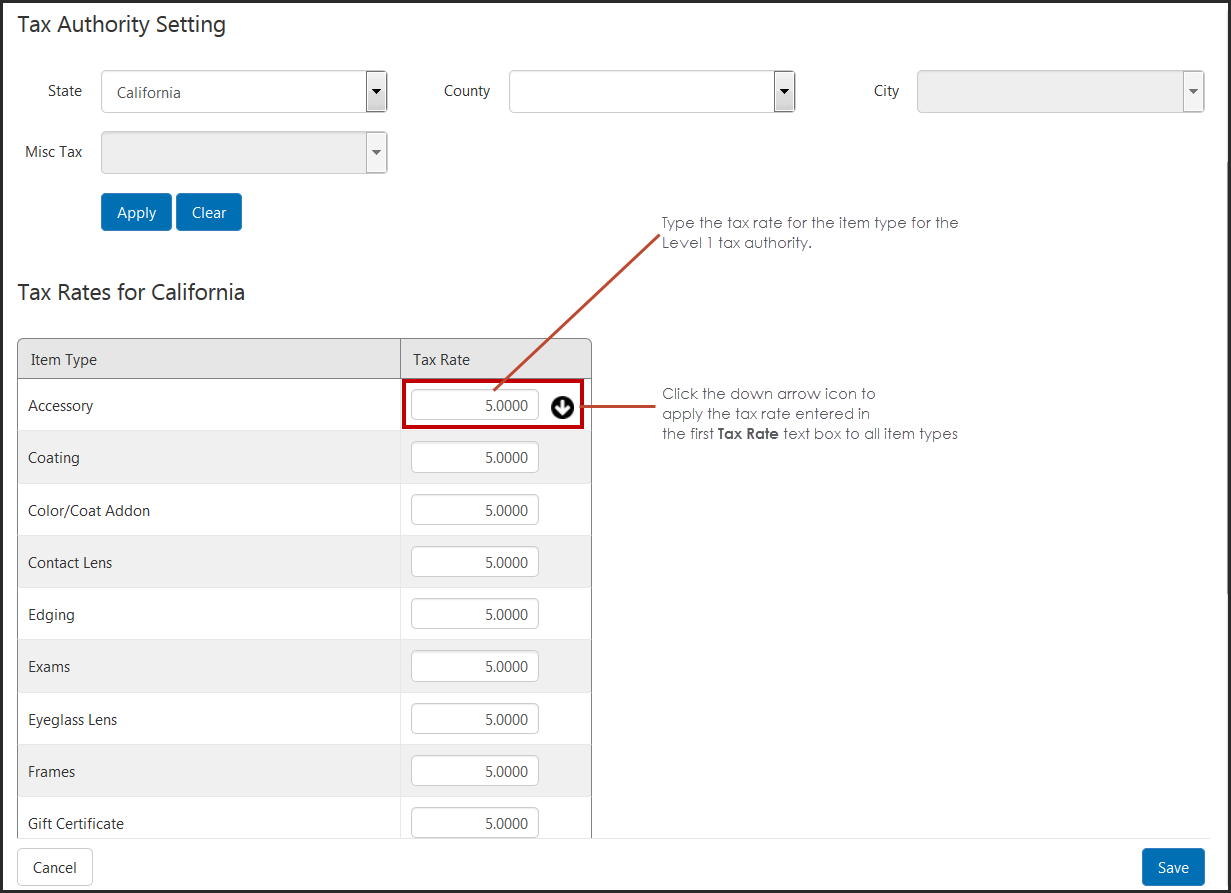

- Select a Level 1 tax authority in the drop-down list for the first tax authority level and click Apply.

- A list of item types set up for your company displays.

- Type the tax rate for the Level 1 tax authority in the Tax Rate text box for each item type.

-

If the tax rate for all item types is the same, enter the tax rate in the first Tax Rate text box and click the down arrow icon to apply the tax rate to all item types.

- Click Save to save the tax rates for the Level 1 tax authority.

- Repeat steps 3 through 5 to set up tax rates for each Level 1 tax authority.

- Repeat steps 3 through 6 to set up tax rates for the second and third tax authority levels and the Misc Tax, if needed.

- You cannot access the Misc Tax drop-down list if you have tax authorities selected in the other tax authority level drop-down list.