Updating Tax Rates for Transactions

Encompass uses the tax rates you set up for your offices to automatically calculate the sales tax for transactions in Front Office. If required, you can update the tax rates for one or more tax authorities for an item in an order. You can also update the tax calculation method or remove taxes for an item in an order.

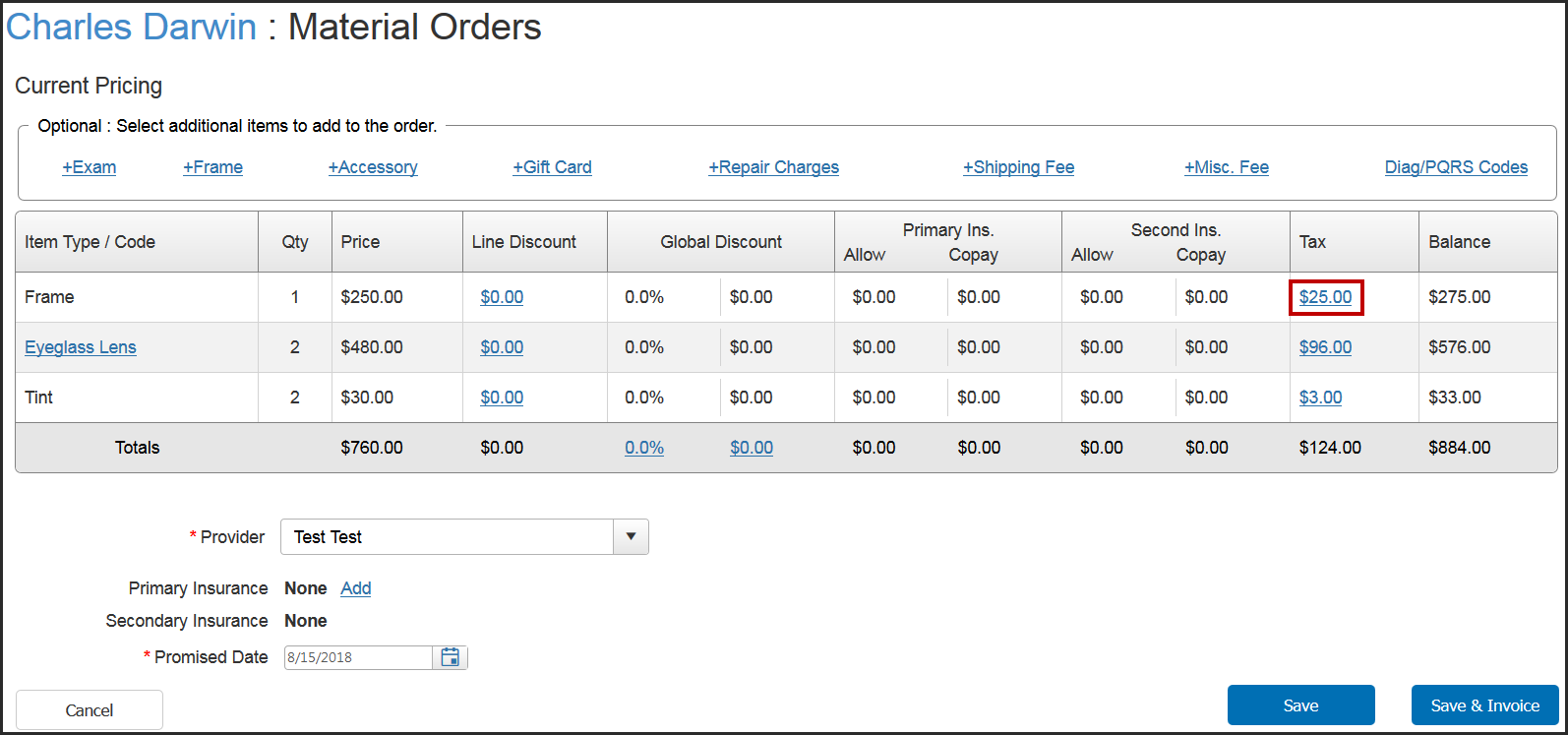

- In Encompass Front Office, search for a patient and click Material Orders.

- Open the Pricing window using one of the following methods:

- Create an order and click Complete Order to Pricing.

- Select Price from the Actions drop-down menu next to an order.

- Click the tax amount link in the Tax column for an item in the order.

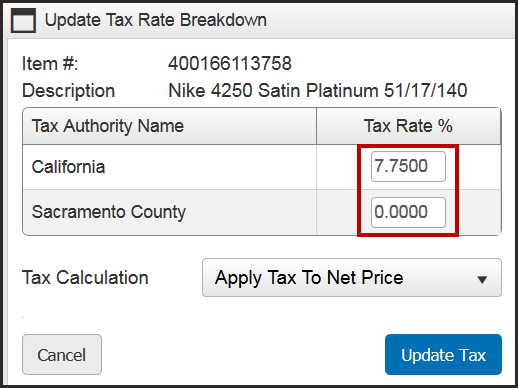

The Update Tax Rate Breakdown window opens.

- Type the updated tax rate in the Tax Rate % text box for one or more tax authorities, if needed.

- Select one of the following options in the Tax Calculation drop-down menu, if needed:

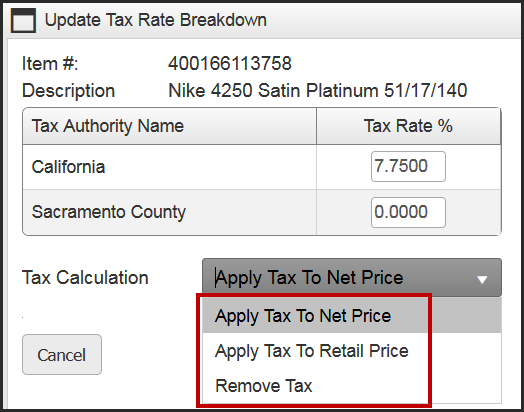

- Select Apply Tax To Net Price to calculate tax for the item based on the net price after discounts. This is the default option selected.

- Select Apply Tax To Retail Price to calculate tax for the item based on the retail price.

- Select Remove Tax to not charge tax for the item.

- Click Update Tax.

- Repeat steps 3 - 6 for other items in the order, if needed.