Average Costing

Average costing is somewhat more complex, but provides for a much more auditable inventory value, consistent with the value exported to the accounting system. When Average Costing is selected, OfficeMate calculates each product’s average cost such that the total inventory value matches the value of inventory as exported to the accounting system.

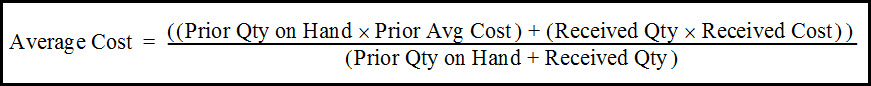

The average cost of each product is calculated whenever the product is received into inventory, according to the following formula:

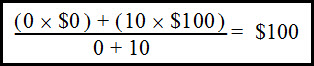

For example, if a initial quantity of 10 of a given product is received at a cost of $100 each, the average cost for the product is calculated as

When the item receipt transaction is posted to the accounting system, the inventory value reported is 10 × $100 = $1000. This is the same value reported by the Inventory Valuation report.

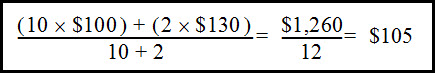

Next, if 2 more units of that same product are received, but at a new cost of $130 each, the system will export the additional $260 inventory value (2 × $130) to the accounting system. The product's new average cost is calculated as

This value is stored with the product and used on the Inventory Valuation report. The report would show an inventory value of 12 (on hand) × $105 (average cost) for an inventory value of $1,260.

This is the same as the total inventory value exported to the accounting system: $1,000 (first receipt) + $260 (second receipt) = $1,260.

When that product is sold, the value of inventory is reduced by the quantity sold multiplied by the average cost. A new average cost is not recalculated when the product is sold or otherwise reduced.

Because the total inventory value reported in the Valuation Report is the same as the net inventory value exported to the accounting system, auditors can verify the inventory value in the accounting system by using reports from OfficeMate. This level of auditability is not possible when using Standard Cost as an Inventory Valuation Method.

For information about setting your inventory valuation method in OfficeMate, see Setting Up the General Ledger Interface.