Using the New VSP Interface for AcuityLogic

We continue to improve our systems and technology to address the changing dynamics of patient care and to better serve you. As part of these efforts, we introduced a new VSP interface. The new interface looks a lot like the interface you're used to, but the underlying technologies have changed.

This section assumes you're already using the AcuityLogic VSP interface, so it describes only the following:

- 1—A preauthorization step you must take for VSP patients.

- 1—Changes you should be aware of as you pull authorizations and submit orders and claims through the new VSP interface.

- 1—How to map eyeglass lens products to the correct Eyefinity and VSP option codes in the new VSP interface.

It also provides a video to teach you how to use the new VSP interface:

Migrating to the New VSP Interface

Eyefinity will notify you of the date your practice will be migrated to the new VSP interface.

Updating VSP Plan Information before Obtaining Authorizations

Before obtaining an authorization for patients who have VSP insurance through the new VSP interface, their Consumer ID must be added to their plan information as follows:

- In AcuityLogic POS, go to the patient's Insurance tab.

- Click Check for VSP Insurance.

The system searches for the patient's VSP record and updates the plan information in AcuityLogic. The patient's Consumer ID is added along with any other new information obtained from VSP.

You can now go to the Add Eligibility window and obtain VSP authorizations for the patient.

For more information about Consumer IDs, see Using Consumer IDs instead of SSNs for VSP.

Changes Related to the New VSP Interface

This section includes the following topics:

- Obtaining Patient Out-of-Pocket Values for VSP Plans

- Using Consumer IDs instead of SSNs for VSP

- Listing Only the Services Covered by a Plan in Eligibilities

- Updating the VSP Patient Record Report

- Viewing Order Status in AcuityLogic POS

- Reformatting the VSP Doctor Service Report

- Using a New Integration to Submit Claims to VSP

- Handling VSP Error and Warning Messages for On-Hold Claims

- Supporting VSP Secondary Coordination of Benefits (COB) Claims

Obtaining Patient Out-of-Pocket Values for VSP Plans

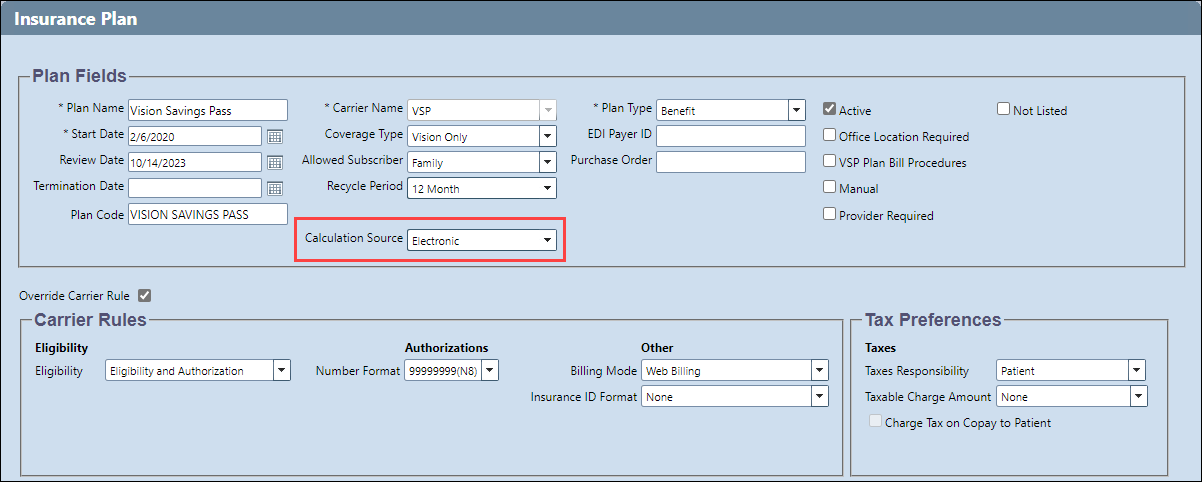

In the Plan Fields section of the Insurance Plan window, a Calculation Source drop-down list was added to support the new VSP interface .

- If Electronic is selected from the drop-down list, the system uses the new VSP interface to obtain patient out-of-pocket values.

- If Fee Schedule is selected, the system behaves as it does for other plans and uses the insurance schedule set up to calculate patient out-of-pocket values.

Using Consumer IDs instead of SSNs for VSP

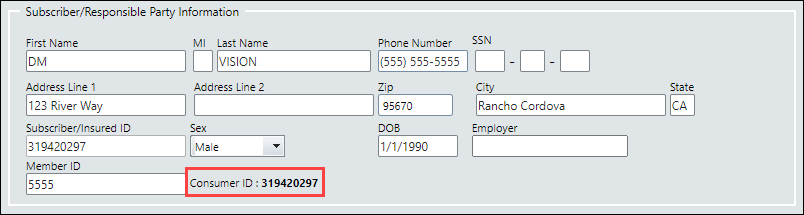

When you use the new VSP interface, a unique VSP patient identifier called the Consumer ID is now displayed in the following locations in AcuityLogic POS:

- The bottom of the patient's Insurance tab

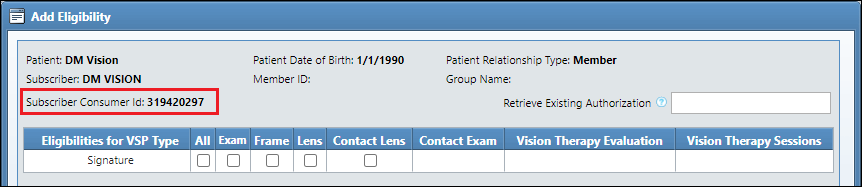

- The top of the Add Eligibility window

-

When you obtain an authorization for a patient using the new VSP interface, AcuityLogic updates the Subscriber/Insured ID with the Consumer ID. See Updating VSP Plan Information before Obtaining Authorizations.

-

The Consumer ID field never displays any part of a patient's social security number (SSN), even if you enter the last four digits of an SSN in the Subscriber Information dialog box when searching for a patient.

-

The SSN or VSP Member ID entered in the Subscriber Information dialog box is displayed in the Member ID field in the patient's Insurance tab. If required, you can copy the value entered and use it to search for the patient at eyefinity.com. The Consumer ID cannot be used to search for patients at eyefinity.com.

-

The Subscriber Consumer ID that is displayed in the Add Eligibility window is the VSP patient identifier for the responsible party. If you are adding eligibility for a dependent of the responsible party, the Subscriber Consumer ID that is displayed will not match the Subscriber/Insured ID in the dependent's Insurance tab.

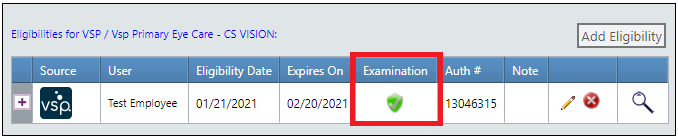

Listing Only the Services Covered by a Plan in Eligibilities

To reduce clutter and prevent confusion, the Eligibilities section of a patient's Insurance tab in AcuityLogic POS now lists only the services covered by the selected plan. Previously, it listed all the services supported by AcuityLogic whether or not the plan covered them.

For example, in the following figure, the VSP Primary Eye Care plan covers only an exam, so that is the only service shown:

- If a service is not covered by the selected plan, it is not shown.

- The spelling of the service name in this section now matches the spelling in the plan (for example, "Examination" instead of the standard "Exam").

- If a service is covered by the plan but the patient is not eligible for the service,

a red shield appears:

- If a service is covered by the plan and the patient is eligible for the service,

a green shield appears:

Updating the VSP Patient Record Report

The format of the VSP Patient Record Report was updated, and the report no longer includes the following items:

- Patient Savings Statement

- VSP Lens Options Chart

To view the Patient Record Report, click the Benefit Details (magnifying glass) icon in the Eligibilities section of a patient's Insurance tab.

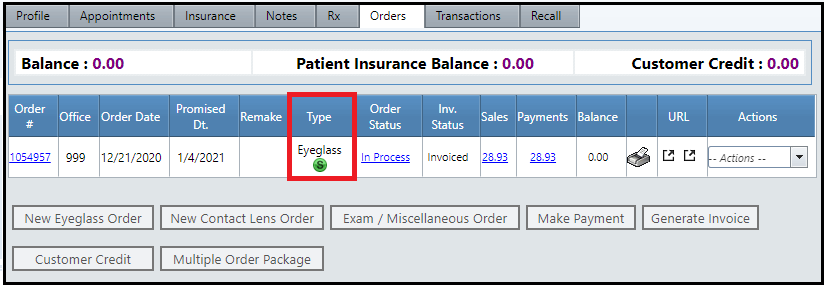

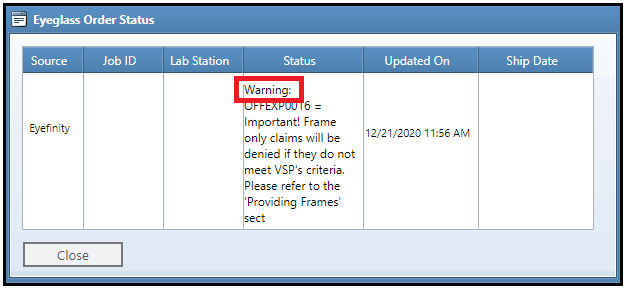

Viewing Order Status in AcuityLogic POS

After a claim is submitted to billing, you can now view the status of its associated order in AcuityLogic POS:

- Submit the claim to billing.

- In AcuityLogic POS, open the patient's Orders tab.

- In the Type column of the order associated with the claim, click the green or red status icon.

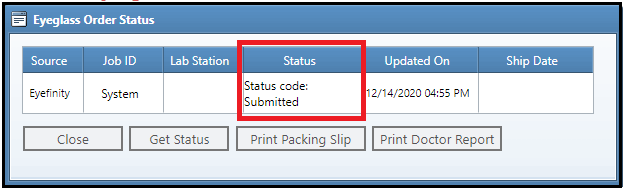

The Order Status window appears:

In addition to viewing the order's status, you can also print its packing slip and its associated VSP Doctor Service Report from this window.

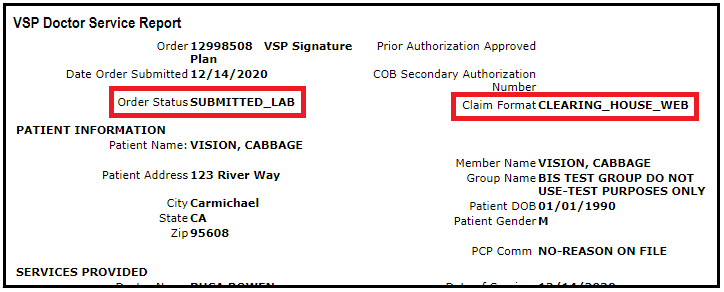

Reformatting the VSP Doctor Service Report

The layout of the VSP Doctor Service Report was reformatted to increase legibility. The following changes were also made to the content of the report:

- The Order Status now indicates whether the claim has been submitted.

- The Claim Format is set to CLEARING_HOUSE_WEB.

Using a New Integration to Submit Claims to VSP

The new Submit Claims Through PMI-CHW daily integration is used to submit claims through the new interface to VSP.

To submit claims through the previous VSP interface, the VSP Eyefinity integration was used.

Handling VSP Error and Warning Messages for On-Hold Claims

While submitting VSP orders and claims through the new interface, you may encounter two types of messages for on-hold claims:

This section explains the difference between those types of messages.

For a list of all the VSP error and warning messages, including explanations and examples, see Errors and Warnings in the New VSP Interface.

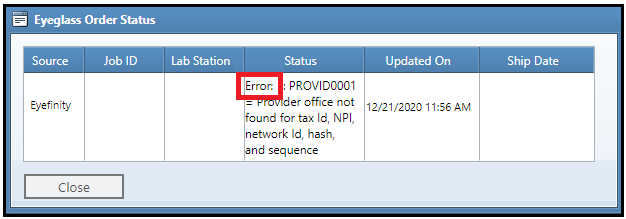

Errors

Errors are identified by the word Error. Errors reflect conditions that must be corrected before the order or claim can be submitted. If you don’t correct the error, the message reappears when you try to resubmit the order or claim.

Warnings

Warnings are distinguished by the word Warning. For warnings, you can do either of the following:

- Fix the order or claim.

- Acknowledge the issue and continue with the order or claim as it is.

For information on how to acknowledge a warning and submit the claim without making any changes to the order or claim, see Acknowledging Warnings in Claims Management.

Acknowledging Warnings in Claims Management

Ideally, you should fix all problems with a claim before submitting it. However, if a claim is on hold due to warnings, you can simply acknowledge them and take the claim off hold so it can be submitted.

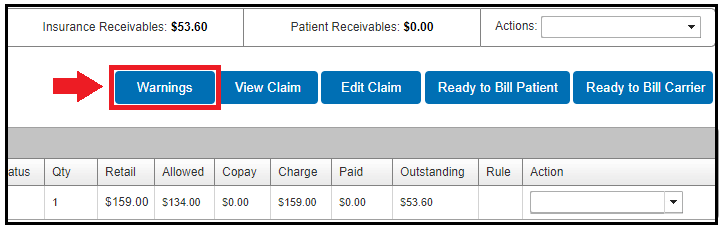

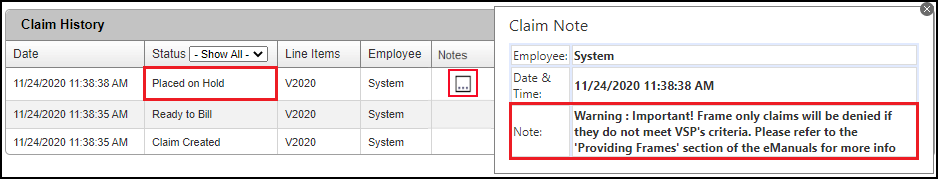

- Open the Claim Detail window for the claim, and check to see if it has warnings:

- If the claim is on hold because of a warning, the new Warnings button appears.

- In the Claim Note window for claims placed on hold, warnings are indicated by the word Warning in the Note field.

- If the claim is on hold because of a warning, the new Warnings button appears.

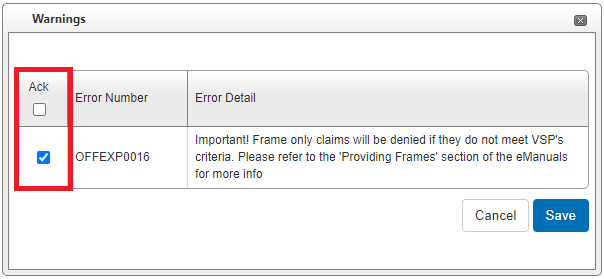

- Click the Warnings button.

The Warnings window opens.

- In the Ack column, select the check boxes of the warnings that you want to acknowledge but not resolve, and then click Save.

- Click Ready to Bill Carrier.

The next time the billing integration runs, the claim is billed.

If you acknowledge warnings, the Warnings button in the Claim Detail window remains visible. If you resolve all the warnings, the Warnings button disappears.

Supporting VSP Secondary Coordination of Benefits (COB) Claims

Coordination of Benefits (COB) enhancements are available only to clients who use the new VSP interface. AcuityLogic 8.18 added these COB enhancements to the new VSP interface in August 2021.

This section includes the following topics:

-

Displaying Secondary VSP COB Claim Information in Edit Claims Window

-

Adding “Paid” Field to ERA Window for VSP Secondary COB Claims

Adding COB Data Fields to Secondary VSP Claims

To enable COB claims to be submitted to VSP as a secondary payment for both medical and well-vision services through the new VSP interface, the following fields were added to the Services Rendered section of the Edit Claim window in AcuityLogic Billing:

-

Other Ins Allowed — Enter the maximum amount the primary carrier is permitted to pay.

-

Other Ins Paid — Enter the amount the primary carrier actually paid.

-

Other Ins Patient Resp — Enter the remaining balance that the patient paid.

-

Denied or Paid Reason — From the drop-down list, select the reason the primary claim was denied or paid $0:

-

Bundled Service: Payment for this service is included in the reimbursement of another billed service or procedure.

-

Capitation: Claim was denied due to capitation (a uniform per capita fee).

-

Deductible: Service was applied to the deductible and paid $0.

-

Max Allowance Met: Maximum allowance was met and paid $0.

-

Not Covered: Claim was denied because the patient was not covered by the primary insurance on the date of the service or services.

-

Timely Filing: Claim was denied due to untimely filing.

-

The new fields are available only when you are using the new VSP interface and processing secondary VSP claims. The field data is not automatically transferred to the corresponding fields in the CMS 1500 form. The monetary fields accept $0.00 but not negative numbers.

Displaying Secondary VSP COB Claim Information in Edit Claims Window

When a claim’s primary insurance is a carrier other than VSP, Box 19 in the Edit Claims window now displays “Secondary COB Claim” for VSP Coordination of Benefits (COB) claims. The new text is displayed above any other data in Box 19. It is added to VSP COB claims in the following circumstances:

-

The primary insurance is medical, and the secondary insurance is VSP.

-

The claim is edited, and the new COB data fields are populated.

-

A payment is received on the primary claim in the Claim Adjustment window (ERA and non-ERA), and the user enters values for the new COB data fields.

Adding Tertiary VSP Authorization for COB

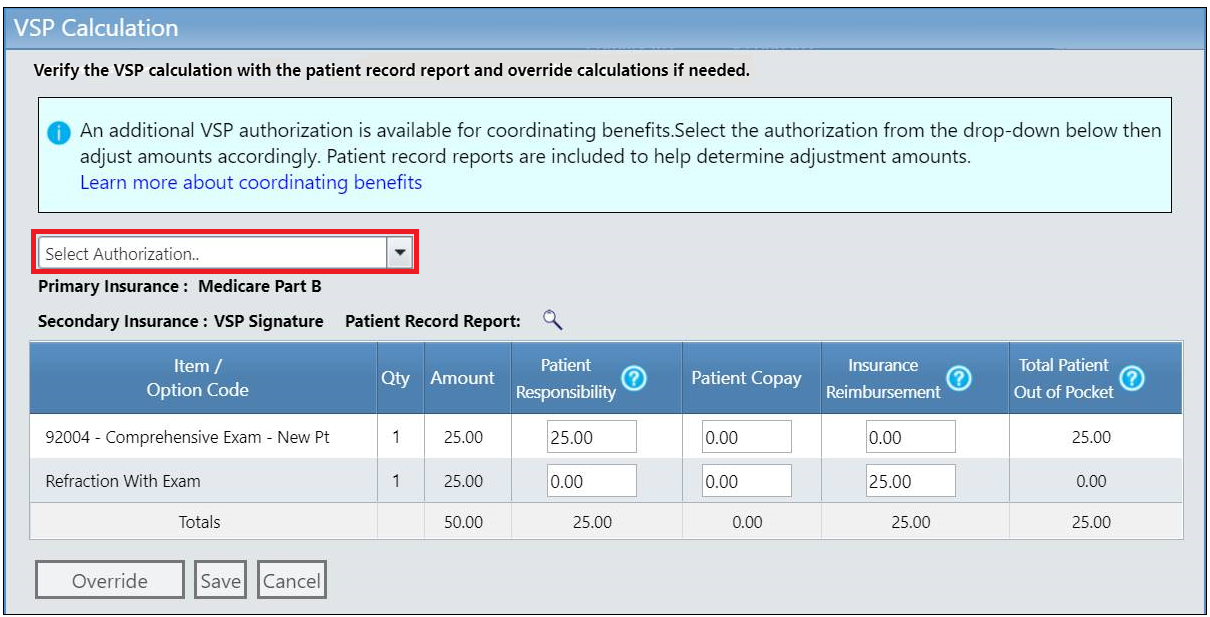

When VSP is the secondary insurance in a Coordination of Benefits (COB) order, a Select Authorization drop-down list appears on the VSP Calculation window to offer “tertiary” (third-level) insurance for the order.

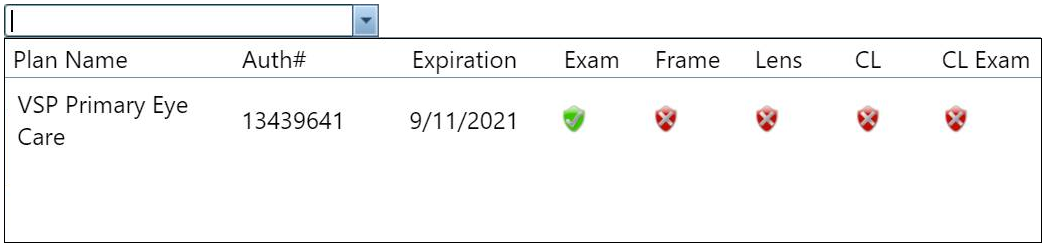

The Select Authorization list contains active VSP authorizations that can be added to the order (excluding the current authorization applied to the order as the secondary insurance). Plan name, authorization number, expiration date, and item eligibilities are included in the list:

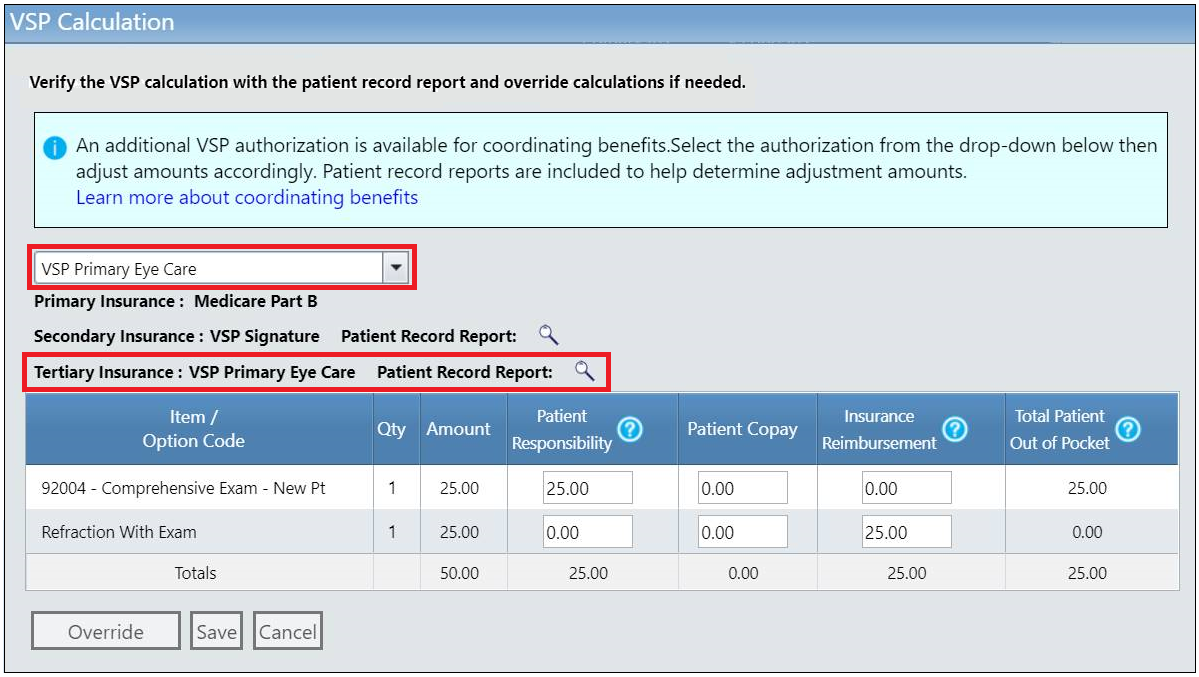

After you select a plan, the plan is listed as the Tertiary Insurance in the window, and its patient record report icon is displayed:

Workflow Details for POS

-

Enter eligibility/authorization for primary medical insurance.

-

Obtain an authorization for only an exam under the VSP Well-Vision plan.

-

Obtain an authorization for only materials under the VSP Well-Vision plan.

It is important to split the VSP Well-Vision plan authorization into an exam-only authorization and a materials-only authorization because the secondary VSP claim must go on hold and cannot be processed until payment is received from the primary carrier. If you bundle the materials with the exam, the material order will also be stuck on hold and delayed. -

Obtain an authorization for only an exam under the VSP medical plan (PEC or DEP Plus).

-

Enter an order for the medical exam, refraction, and any procedures.

-

Apply the primary medical insurance.

-

Apply the secondary VSP authorization.

-

In the Select Authorization drop-down list, the VSP medical authorization (PEC or DEP Plus) appears, and the user can select the tertiary authorization to add to the order. It does not affect pricing because the order was priced when the secondary insurance was applied.

-

In the VSP Calculation window, click Override.

-

In the confirmation message, click OK to override the VSP calculation.

-

Manually calculate the coverage between the secondary and tertiary VSP plans.

Workflow Details for Billing

-

Billing submits the primary claim to the primary medical insurance, and the secondary VSP COB claim stays on hold until the Explanation of Payment (EOP) is received from the primary carrier.

-

The biller edits the secondary VSP claim and populates the COB values.

-

With this information filled out, the claim can be set to ready-to-bill and submitted in the next VSP claim submission integration cycle.

Updating Invoices to Support VSP COB Tertiary Insurance

All invoices in AcuityLogic can now display the plan names of tertiary insurance applied to VSP Coordination of Benefits (COB) orders.

Adding “Paid” Field to ERA Window for VSP Secondary COB Claims

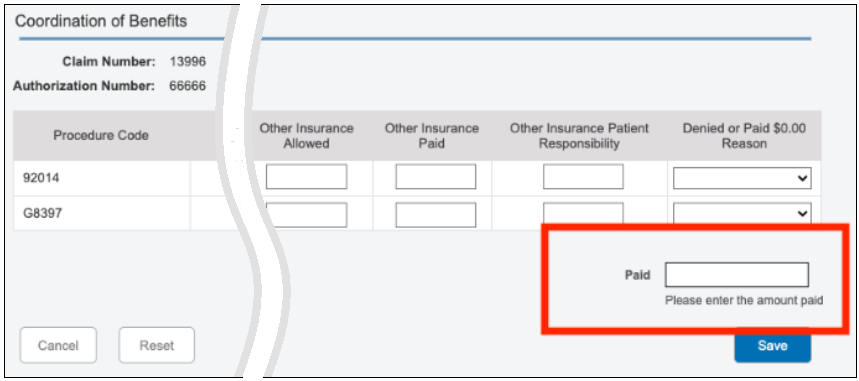

A new Paid field was added to the bottom of the Electronic Remittance Advice (ERA) Claim Adjustment window for secondary Coordination of Benefits (COB) claims being sent to VSP. The new field corresponds to Box 29 (Amount Paid) on the eyefinity.com claim form. Its value should be the total amount of the Other Insurance Paid fields. You must enter the value; the field is not automatically populated.

Handling VSP Interface Outages

Update included in AcuityLogic 8.30

If there's a problem with the VSP interface that temporarily prevents a claim from being submitted, the claim is no longer automatically put on hold. The system now keeps the claim in Ready to Bill status and makes additional attempts to submit it every two hours, up to 10 attempts. The Claim Note is updated to show how many attempts have been made. If, after 10 attempts, the claim still cannot be submitted, it is then put on hold.