Setting Up Office Tax Rates

After you set up the tax authorities and tax rates for your company, you can set up the tax rates for your offices by assigning the tax authorities to each office. Encompass calculates the sales tax for each item type by totaling the tax rates of the assigned tax authorities.

- From the office, click Office Information. See Navigating Administration for information on how to get to Office: Setup.

- Under Tax Information, click the Review link.

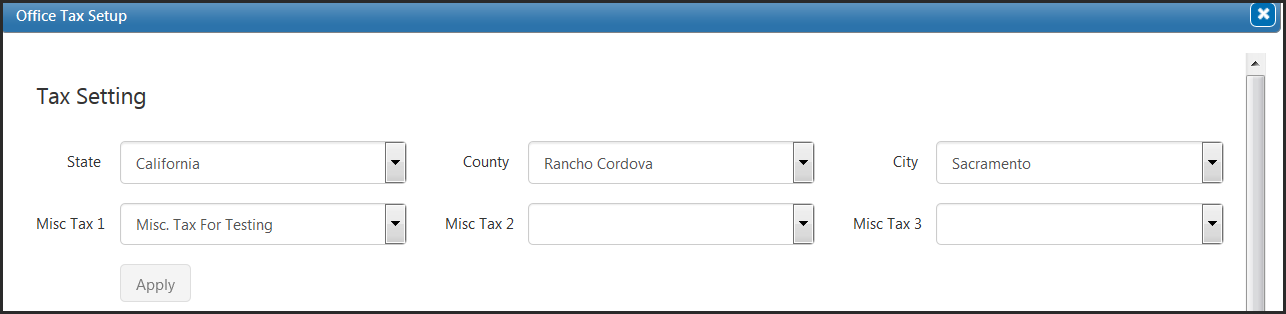

The Office Tax Setup window opens.

- Select the tax authorities you want to assign to the office in each of the drop-down menus in the Tax Setting section.Set up only the tax authorities for the tax authority levels you need for your company.Select the tax authorities for the three tax authority levels in order. For the default state, county, and city tax authority levels, select a state tax authority before selecting a county tax authority and a county tax authority before selecting a city tax authority.

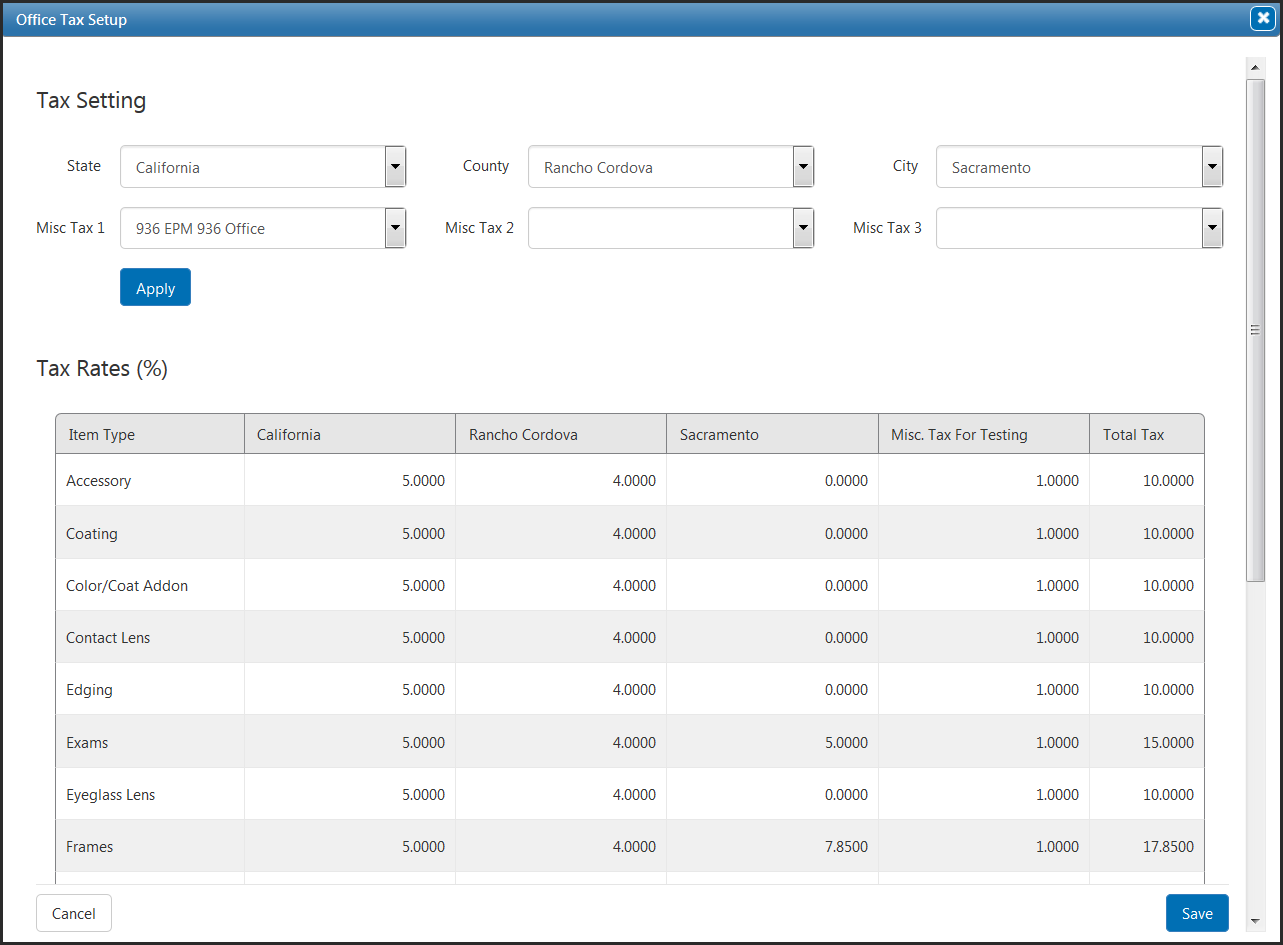

- Click Apply.

The tax rates for the assigned tax authorities and total tax rate for each item type display.

- Click Save.

The Office Tax Setup window closes, returning you the Office Information screen.

- If you want your patient invoices to show the tax broken out by tax authority, select Display Detailed Tax on Patient Receipt.

- Click Save.

- Repeat this procedure for each office.