Applying Insurance for Coordination of Benefits (COB)

You can add both a primary and a secondary insurance to an order for coordination of benefits.

What do you want to do?

Claims for medical/VSP coordination of benefits must include both a primary medical diagnosis code and a routine vision diagnosis code, and all line items on the order must be exam-only.

- Create the exam order and click Save.

- In the Pricing screen, click the Add link to add a medical insurance plan as the Primary Insurance.

The Select Insurance window opens.

- Select Exam/Contact Lens Exam and click Calculate Benefits next to the medical insurance plan.

- Enter the Insurance Reimbursement amounts that the medical insurance will cover in the Manual Calculation window and click Save.

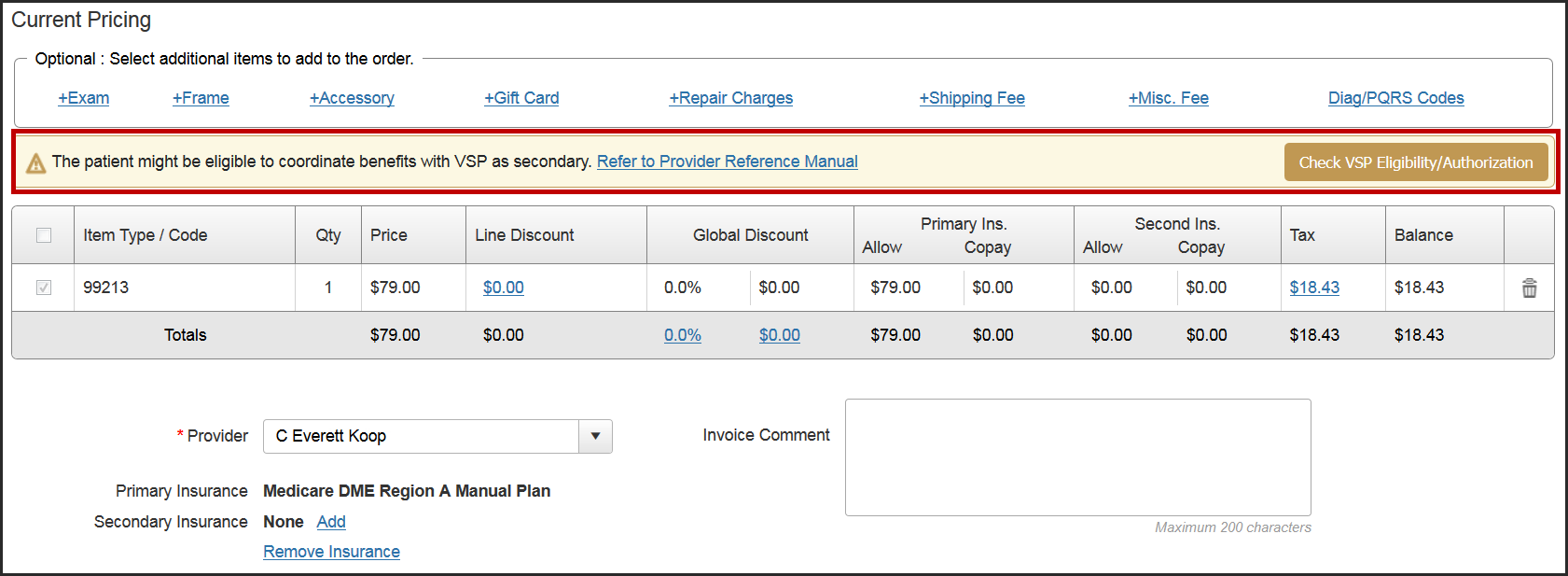

- If the patient has VSP insurance in the system, a message appears, stating that the patient might be eligible to coordinate benefits. Click Check VSP Eligibility/Authorization to open the Eligibility/Insurance screen in another tab.

- If the patient has an active VSP authorization for exams, return to the Pricing screen and click theAddlink to add it as the Secondary Insurance.

The Select Insurance window opens.

- Select Exam/Contact Lens Exam and click Calculate Benefits next to the VSP plan.

- In the VSP Calculation window, click Override and enter the amounts that VSP will cover (for example, the refraction fee). Only providers and staff members with the Override VSP Calculation security permission selected in Administration can use the Override feature. If you do not have this security permission, an Access Denied - Temporary Override window displays, allowing another user with permission to enter their username and password and give you temporary access. For information on setting security permissions, see Setting Up Provider Security Settings and Setting Up Staff Security Settings

- Click Save.

- Click Save & Invoice.

After you generate the invoice:

- The primary medical claim is created, and automatically includes the secondary VSP insurance information. The claim is set to Ready to Bill status. Process it as you normally would.

- The secondary VSP claim is set to On Hold status. For instructions on processing the claim, see Processing Claims for Coordination of Benefits (COB).

To apply VSP insurance as primary and secondary insurance:

- Search for the patient record, and click Eligibility/Authorization.

- Select eligibilities and obtain authorizations for the two VSP plans you want to apply.

- Create the order.

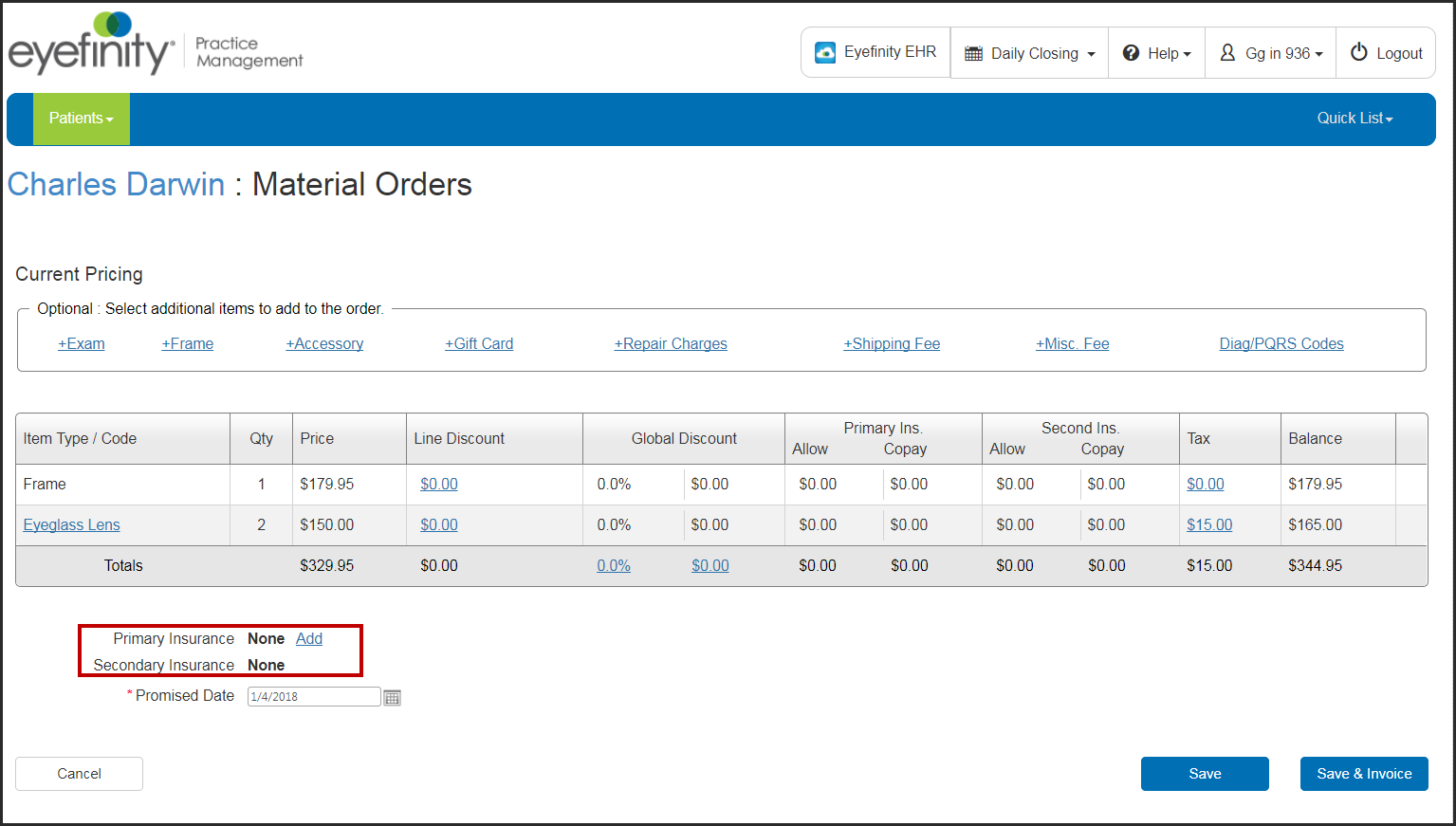

- On the Material Orders Current Pricing screen, click the Add link next to Primary Insurance.

- In the Select Insurance window, select the check boxes for the eligibilities you want to include in the benefits calculation, and click Calculate Benefits next to the primary insurance.

- Make edits in the VSP Calculation window as needed, and click Save.

- On the Current Pricing screen, click the Add link next to Secondary Insurance.

- In the Select Insurance window, select the check boxes for the eligibilities you want to include in the benefits calculation, and click Calculate Benefits next to the secondary insurance.

The Manual Calculation window opens. Secondary insurance benefits must be manually entered.

- Record the allowances for the secondary insurance in the Allowance column, and enter any Patient Copayments.

The allowances you enter autopopulate the Insurance Reimbursement column and the amounts in the Patient Responsibility column are adjusted.

- To view the Patient Record Report for the Primary or Secondary insurance, click the magnifying glass icon.

- Click Save.

- Click Save again to save the order for invoicing later, or click Save & Invoice to generate the invoice immediately.

Once you generate the invoice, the claim is created and the order is sent to the desired VSP lab. The primary insurance claim status is set to Ready to Bill, and the secondary insurance claim status is set to Billed.