Eyefinity Practice Management 10.15 Release Notes

Release Date: January 13, 2020

Eyefinity announces the newest version of Eyefinity Practice Management. This updated version improves upon your system's robust attributes and offers new features and expanded functionality.

This section includes:

Front Office Enhancement

Eyefinity Practice Management 10.15 Front Office includes an enhancement to the following area:

VSP Global® Premier Program Updates

Discover new Premier Program tiers, where you can set your sights on the benefits you want most, and reward your practice with every step you take. Access all this and more on VSP Provider Hub—an all-new web experience designed to make it easier for you and your staff to connect with the information you need from the Premier Program and all VSP businesses. Click on the Premier Dashboard tile on the Eyefinity Practice Management to access your practice dashboard and view your tier level, benefits, and program offers.

Administration Enhancements

Eyefinity Practice Management 10.15 Administration includes enhancements to the following areas:

- Payment Rules to Automatically Adjust Electronic Remittance Claims

- Custom Frame Setup Changes to Prevent Duplication Issues

Payment Rules to Automatically Adjust Electronic Remittance Claims

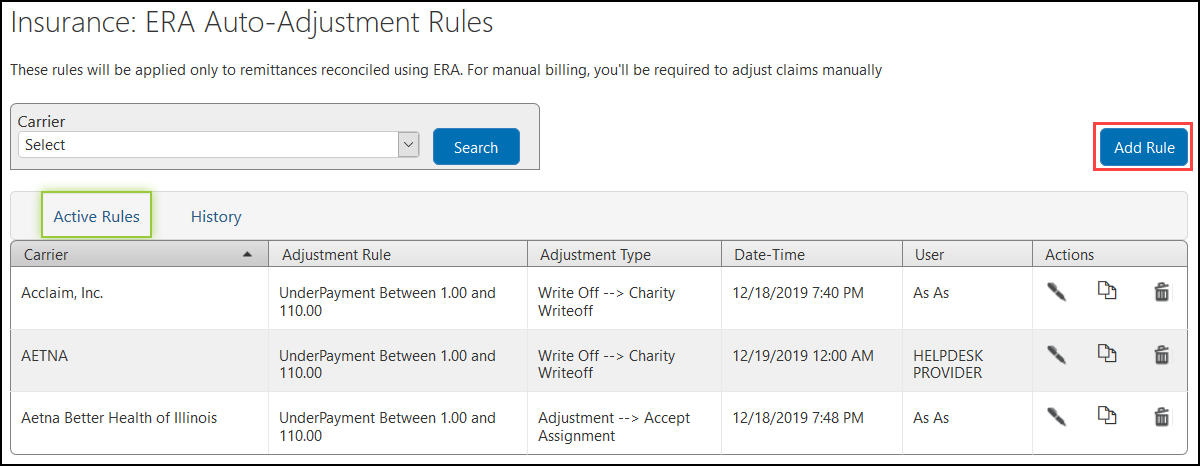

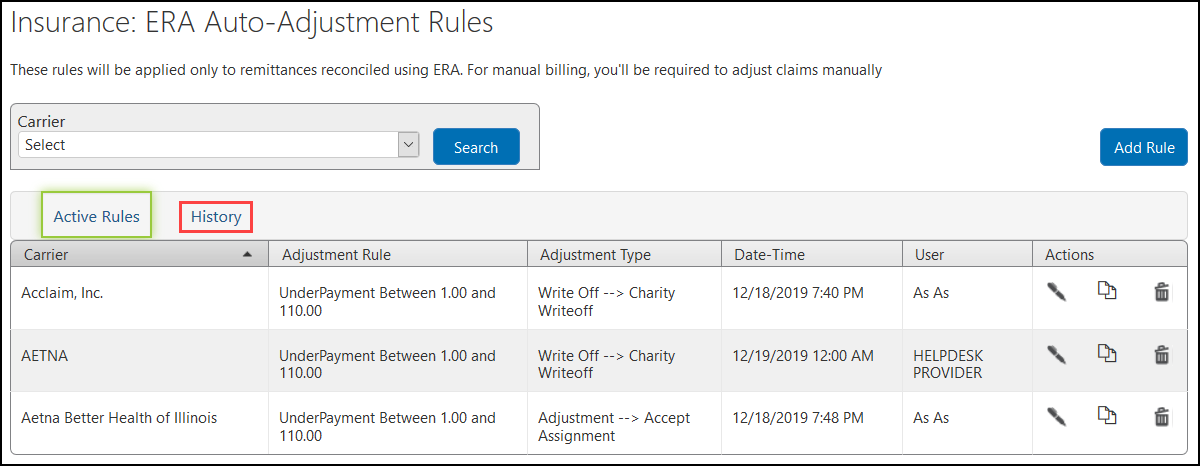

This enhancement applies only to offices that use electronic remittances. For more information on electronic remittances in Eyefinity Practice Management, see Processing and Posting Electronic Remittance Payments (ERA).

To simplify the remittance posting process, you can now create company-level insurance payment rules to automatically adjust or write off underpaid claims. When a remittance is downloaded to Eyefinity Practice Management, the payment rule created for its carrier is applied to any underpaid claims in the remittance, which the system then automatically adjusts or writes off according to the rule.

- Each carrier can be associated with only one payment rule.

- Payment rules are applied to remittances only when the remittance is initially downloaded.

- Payment rules are not applied to the following:

- External claims

- Manually processed claims

- Overpaid claims

- Remittance adjustments

- Line items with nonpayable statuses such as On Hold, Ready to Bill, Bill to Patient, and Canceled

-

You can review claims adjusted by insurance payment rules in the following locations in Claims Management:

-

The Not Applied or Applied tabs of the Remittance Details window

-

The Claim History section of the Claim Detail window; payment rules are listed in the Claim Notes

-

This section includes the following topics:

- Creating Insurance Payment Rules

- Searching for Active Payment Rules

- Editing a Payment Rule

- Deleting a Payment Rule

- Copying a Payment Rule

- Viewing Active and Inactive Rules in the Payment Rules History

Click here to watch a video tutorial.

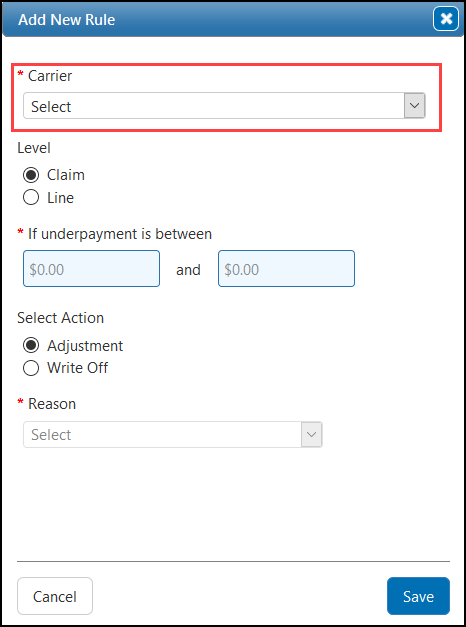

Creating Insurance Payment Rules

- From the menu, select Insurance and select Payment Rule Setup.

- Click Add Rule.

- In the Add New Rule window, select the Carrier.

- Select whether the rule applies to an entire claim or only to a claim line item.

If you select Claim:

If any line item is overpaid, the payment rule is not applied to the claim.

If multiple line items have the same procedure code (such as V2799 for miscellaneous items), the payment rule is not applied to the claim.

If you select Line:

If a claim has overpaid and underpaid line items, the payment rule is applied only to the underpaid items.

-

Enter a dollar range for the outstanding balance (for example, 0.00–5.00). The first value in the range must be less than the second value.

-

Select whether the rule creates an adjustment or a write-off, and select the reason for the adjustment or write-off from the associated drop-down list.

- Click Save.

The new rule appears in the Active Rules table.

Searching for Active Payment Rules

- From the menu, select Insurance and select Payment Rule Setup.

-

If you know the carrier associated with the rule you want to find, select it from the Carrier drop-down list to filter your search results.

If you do not specify a carrier, the search returns all the active payment rules.

- Click Search.

The active payment rules that match your search criteria are listed in the Active Rules table.

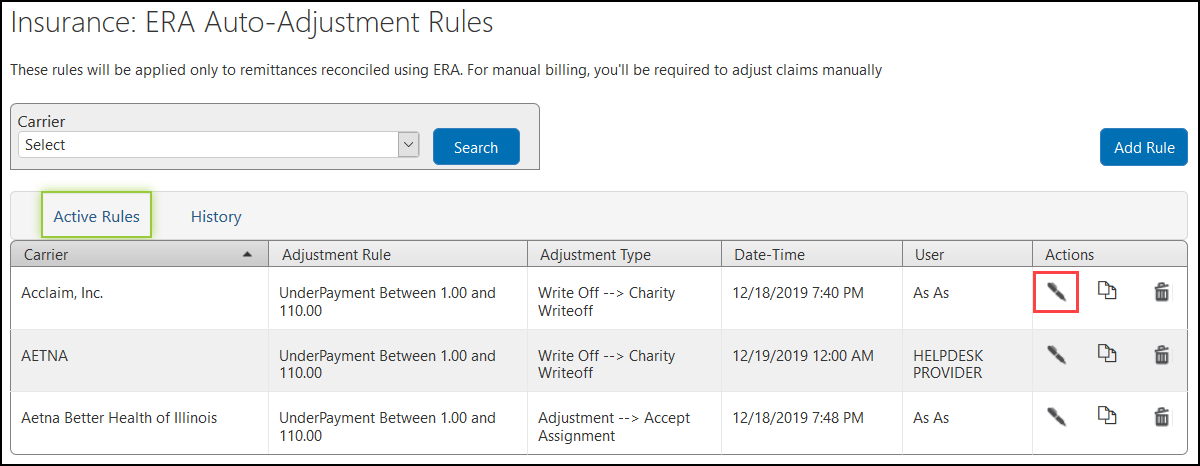

To change a payment rule, click the rule's Edit (pen) icon in the Actions column of the Active Rules table.

- If the rule was used, it is inactivated, and the edited version becomes active. The inactive version is not removed from claims to which it was applied; the active version is applied only to remittances downloaded after it was saved.

- If the rule was not used, your edits apply to the current version, which remains active.

To delete a payment rule, click the rule's Delete (trash can) icon in the Actions column of the Active Rules table.

-

If the rule was used, it is inactivated but not removed.

-

If the rule was not used, it is removed.

You can copy active payment rules from one carrier to create new rules for other carriers.

- From the menu, select Insurance and select Payment Rule Setup.

-

Find the rule you want to copy. See Searching for Active Payment Rules.

- In the Actions column of the Active Rules table, click the Copy icon for the rule you want to copy.

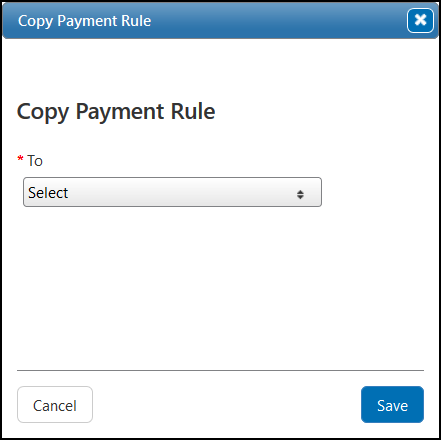

- In the Copy Payment Rule window, select the carrier to which you want to copy the payment rule. You can select multiple carriers.Carriers with active rules do not appear in the To drop-down list. You cannot copy a payment rule to a carrier that already has an active rule. Delete the active rule before proceeding. See Deleting a Payment Rule

- Click Save.

The rule is added to the Active Rules table for each carrier you selected.

Viewing Active and Inactive Rules in the Payment Rules History

- From the menu, select Insurance and select Payment Rule Setup.

- If you know the carrier whose rule history you want to find, select it from the Carrier drop-down list to filter your search results.

- Click the History link above the rules table.

The payment rules table is updated. If you specified a carrier, the table lists all the active and inactive insurance payment rules for that carrier. Otherwise, it lists all the active and inactive insurance payment rules.

Custom Frame Setup Changes to Prevent Duplication Issues

To prevent problems with duplicate frames in the database, we have removed the option to create new manufacturers and collections in Administration. The +Manufacturer and +Collection buttons have been removed from the Custom Frame Setup screen. You must now contact Eyefinity Customer Support to add new manufacturers and collections to your system.

Beta Test Opportunity

We have the following new Beta testing opportunity for interested practices.

Credit Card Processing with Worldpay

If your practice has Worldpay integrated with Eyefinity Practice Management, you can use Worldpay to quickly and easily process credit card payments, returns, voids, price adjustments, and customer credit refunds.

Worldpay requires one of the following terminal devices to capture credit card data:

- Ingenico iSMP4 (wireless)

- Ingenico iPP 320 (wired)

For more information, see Processing Transactions Using Worldpay.

Fixed Issues

Front Office

-

Contact Lens remake orders will be removed from the ABB batch shopping cart to prevent invalid orders submitted during integration.

- Demographics now warns you when there are invalid details in a patient's record to help eliminate billing claim errors and insurance rejections.

- When VSP insurance information is obtained for dependents using the + Check for VSP Insurance feature, the subscriber's date of birth is now imported to Eyefinity Practice Management along with the rest of the insurance information. Previously, the subscriber's date of birth was missing, causing claims to go on hold.